boulder co sales tax license

If another city tax is charged and the vendor is not licensed with Boulder it is not a legally imposed tax and credit is not allowed. Sometimes taxpayers refer to this as a business registration but it is an application for a Colorado sales tax account or sales tax license.

Sales Tax Campus Controller S Office University Of Colorado Boulder

LicenseSuite by Business Licenses LLC provides you with everything you need to obtain a Boulder Colorado Sales Tax Permit.

. Sale Tax License Simple Online Application. How to Apply for a Sales and Use Tax License. Taxes and Fees are likely to cost more due to the heavier weight of these vehicles.

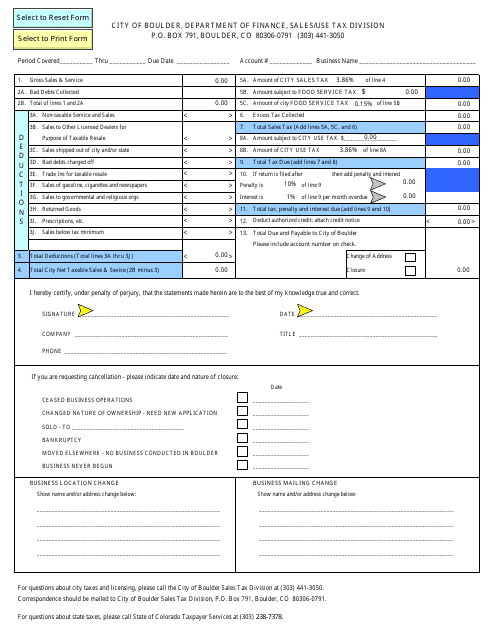

Sales Tax Accounts Licenses. Ad Sale Tax License Wholesale License Reseller Permit Businesses Registration. Sales 000 of line 4 000 000 5C.

File for boulder-county Business Licenses and boulder-county Permits at an affordable price. Local sales taxes to the county clerk at the time of registration. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

For organizations not based permanently in the City of Boulder we have a Special Event License available. Purchaser should contact vendor for refund of the taxes charged in error. PO Box 471 Boulder CO 80306.

Therefore all businesses engaged in business in the city must have a City of Boulder business license. The Colorado state sales tax rate is currently. A weight slip will be required for out-of-state vehicles if the empty weight is over 4500 pounds and is not listed on the title.

Complete a Business License application or register for a Special Event License. For hauling companies that collect transport or dispose of discarded materials garbage recyclables trash or compostables Liquor licenses in unincorporated Boulder County are administered by the Boulder County Commissioners Office. RVs and Motor Homes.

The minimum combined 2022 sales tax rate for Boulder County Colorado is. Amount of city FOOD SERVICE TAX 015 of line 5B 6. Drivers licenses are issued and renewed by the Colorado Department of Revenue.

If Boulder tax is properly charged credit is allowed. Excess Tax Collected 000 7. Httpsbouldercoloradogovtax-licensesales-and-use-tax for more information on tax and licensing including tax rates tax guidance and FAQs.

The 2018 United States Supreme Court decision in South Dakota v. Get Your Sales Tax Permit. The Boulder Revised Code defines engaged in business in the city as.

This page serves as a guide to navigating the Special Event tax system and the City. When you select the form Preparation Service package below all the license permit tax registration applications required for your specific type and. The City of Boulder requires all organizations and businesses coming into Boulder for Special Events to obtain a City of Boulder business license and file a sales use tax return.

Vendor must have a Boulder sales tax license in order to charge and collect Boulder tax. Quickly Apply Online Now. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Boulder Colorado Tax Registration.

Vehicles purchased outside of Colorado Motor vehicle sales made outside of Colorado are not subject to Colorado sales tax. Dont waste your time run your small business - avoid the paperwork the hassle and the delays by filing for licenses and permits online. Proof of paid sales tax is required at the time of registration see instructions for sales tax paid to another state.

Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont. Please visit our web site at. Please see Motor vehicle sales earlier in this publication for rules for determining the applicable local sales and use taxes.

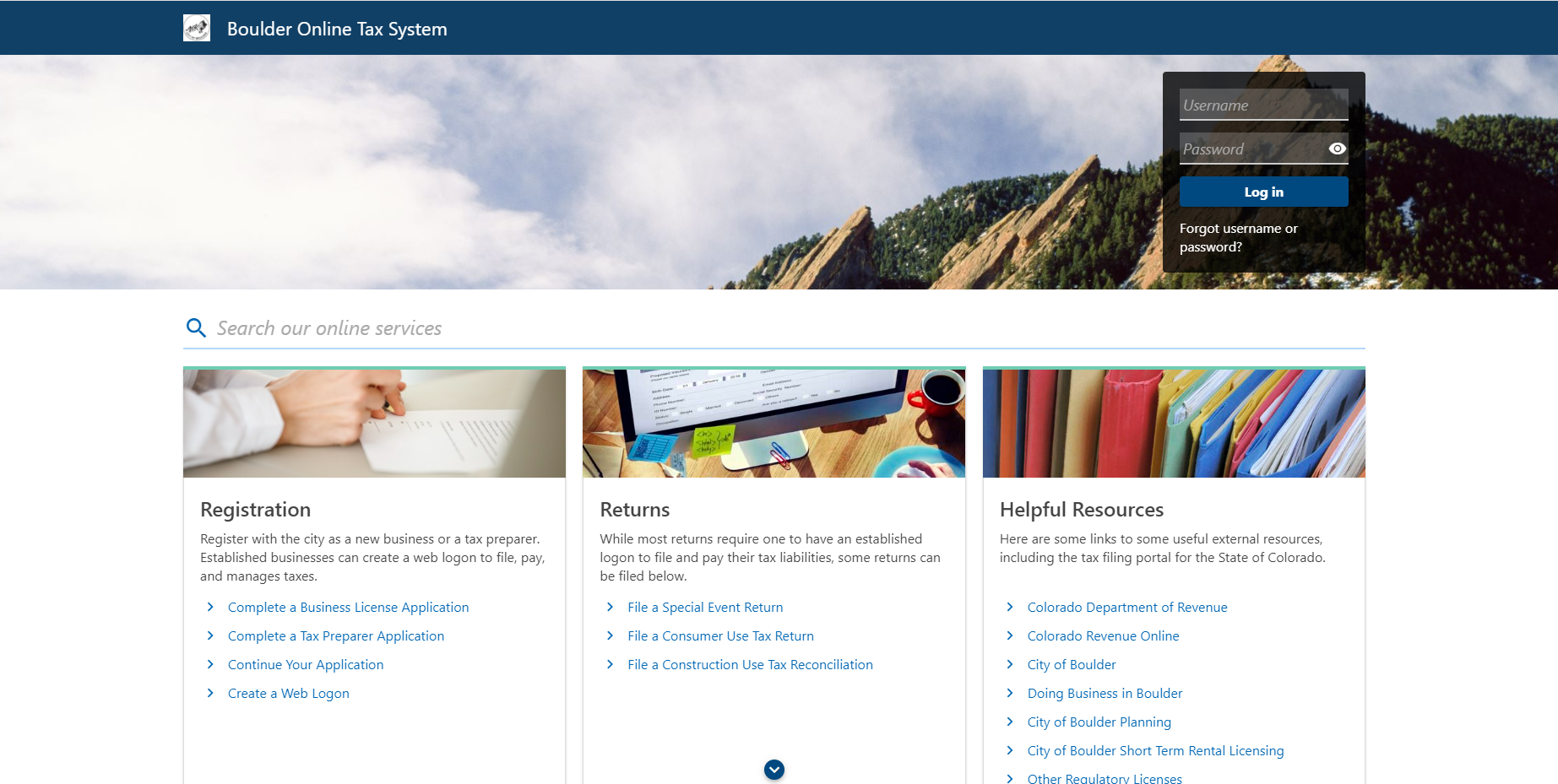

State county city and regional transportation district sales use taxes are based on the. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue. Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely.

Colorado law requires motor homes and RVs to be titled and registered the same way as other motor vehicles. We Make the Process of Getting a Boulder Colorado Sales Tax Permit Simple. The City of Boulder is considered a home-rule city meaning it administers Boulder sales tax separately from the State of Colorado.

This is the total of state and county sales tax rates. Has impacted many state nexus laws and sales tax collection requirements. The Fastest Way to Get Your Sales Tax Permit.

Ad Get Your Sellers Permit for Only 6995. File online tax returns with electronic payment options. The Colorado sales tax license in other parts of the country may be called a resellers license a vendors license or a resale certificate is for state and state-administered sales and use taxes.

13 rows Boulder County does not issue licenses for sales tax as the county sales tax is. City of Boulder Sales Tax Form. Colorados state sales tax is 9 and its 0 percent.

Fast Easy and Secure Online Filing. How to Apply for a Sales and Use Tax License. Sent direct messages to Sales Tax Staff.

Each physical location must have its own license and pay a 16 renewal fee. This is the total of state county and city sales tax rates. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

A Boulder Colorado Sales Tax Permit can only be obtained through an authorized government agency. 2 rows When the university sells tangible property to non-university non-tax-exempt entities the sale. A Boulder Colorado Tax Registration can only be obtained through an authorized government agency.

Skip the Lines Apply Online Today. The Boulder County sales tax rate is. For questions about city taxes and licensing please call the City Boulder Sales Tax Division at 303 441-3051 email at salestaxbouldercoloradogov or send a message through Boulder Online Tax.

If a vehicle is purchased from a private party all sales taxes are collected by Boulder County Motor Vehicle. When you choose to work with Business Licenses LLC our experienced professionals can. Return the completed form in person 8-5 M-F or by mail.

Any unpaid sales taxes are collected by Boulder County Motor Vehicle. Renewed licenses will be valid for a two-year period that began on January 1 2020. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to.

Those engaged in business in the City of Boulder.

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax Campus Controller S Office University Of Colorado Boulder

315 Bellevue Dr Boulder Co 80302 Realtor Com

Getting Your Business Established In Boulder Colorado

Construction Use Tax City Of Boulder

Boulder Skyline Art Print Boulder Decor Colorado Flatirons Etsy

Getting Your Business Established In Boulder Colorado

915 Lawn St Boulder Co 80303 Realtor Com

2 Benchmark Dr Boulder Co 80303 Mls 4753123 Redfin

Sales And Use Tax City Of Boulder

Short Term Dwelling And Vacation Rental Licensing Boulder County

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

5313 Westridge Dr Boulder Co 80301 Realtor Com